Given counselling’s weird, unregulated status in the UK, insurance for counsellors isn’t actually a legal requirement.

I know. It seems insane, but it’s true.

The fact is that you could convert your spare room into a therapy room today, put up flyers advertising yourself as a therapist tomorrow, and see your first client on Friday without ever being insured.

Sure, plenty of people would frown upon it, but nobody could actually do anything to stop you.

Still, as the old saying goes, just because you can, doesn’t mean you should.

Whatever your thoughts on therapy regulation in the UK may be, you surely have to admit that jumping into private practice without anything in place to protect you and your clients is pretty bloody stupid.

After all, doesn’t practicing without insurance raise all kinds of red flags regarding ethical practice?

Besides, even if you decide to be an uninsured therapist, you won’t get very far and certainly won’t be able to access the same resources and opportunities as your fully-insured colleagues.

In this guide, I’ll explain exactly why a lack of insurance will hinder your progress as a therapist and offer my recommendations on the best insurance companies for counsellors in the UK.

What Kind of Insurance Do I Need as a Counsellor in the UK?

The two main types of counselling insurance you’ll need to practice in the UK are public liability and professional indemnity.

Public Liability Insurance

Public liability insurance covers you against claims of personal injury or damage to a client’s property.

For example, let’s say a client visits your practice, trips on the stairs on their way up to your therapy room, and decides to pursue you for compensation.

Public liability insurance would cover you for that.

It’s also designed to cover you if you accidentally break something belonging to that client.

Professional Indemnity Insurance

Professional indemnity insurance protects you should you be sued for negligence, even if you did nothing wrong.

Although those of us trained in person-centred counselling are taught not to give advice to our clients, it’s not beyond the realms of possibility that a client takes action based on something discussed in a counselling session that results in negative consequences.

That client could then decide to take you to court, claiming that the advice or guidance you gave them caused them harm.

In that instance, professional indemnity insurance would help cover the legal costs of dealing with such a claim.

All three UK insurance companies in this guide provide professional indemnity and public liability insurance as standard.

Some will also offer additional coverage at an extra cost.

Such coverage includes:

Equipment Breakdown

Talk therapies don’t require much equipment, but we all need to use a computer or a tablet, a secure external drive, and other bits and pieces to run our business.

As you can imagine, equipment breakdown insurance covers you if your essential business equipment breaks.

This doesn’t cover normal wear and tear, nor does it protect you if your equipment breaks due to negligence or inadequate maintenance, but if you’ve been taking care of your stuff and it breaks anyway, equipment breakdown coverage should help.

Employer’s Liability

If you’ve grown your private practice to the point of employing other therapists or admin support, employer’s liability insurance is essential.

This will help you to cover some of the costs if an employer files a claim against you for injury or illness caused at work.

Loss of Income and Business Interruption

No matter what kind of business you run, it’s always a good idea to have a contingency plan in case you cannot work.

From personal accidents and illnesses to fire and flood damage, all kinds of unforeseen events could derail your ability to see clients and make a living.

Investing in loss of income insurance and/or business interruption insurance will provide some level of protection in such circumstances.

4 Reasons Why You Need Counsellors Insurance for Your Private Practice

1. You’ll Struggle to Rent a Therapy Room

Any reputable therapy room provider will ask for your credentials and insurance before they allow you to rent a room.

It’s as simple as that.

In the past, I’ve worked in all kinds of locations, from a purpose-made therapy centre to a spare room above a beauty salon, and everywhere I’ve been, I’ve had to prove that I’m insured.

When you think about it, this makes sense.

If a venue were to let an uninsured therapist work there, there’s every chance that they could find themselves liable should something go awry. Not only is that likely to cost them financially, but when word gets out, it could also cause insurmountable damage to their reputation.

To cut a long story short, you’ll have a tough time getting a professional location for your therapy practice without insurance.

2. You Won’t Be Accepted by Associations or Directories

Just as you’re not obligated to get insurance, there’s no obligation to become a member of organisations like the BACP.

Still, many counsellors and other therapists choose to become accredited for all sorts of reasons.

For some, it’s to take advantage of professional support and guidance.

For others, it’s to access Continuing Professional Development (CPD) opportunities and networking events.

For still others, it’s simply about establishing a sense of legitimacy for their practice.

Even if you decide not to join such organisations, you may still want to use platforms like Counselling Directory to attract new clients.

Both accredited organisations and directory sites will only accept you if you’re insured.

Again, that may not be a big deal to you, but when you consider the low cost of insurance for counsellors in the UK, it’s just silly to deny yourself opportunities to grow your business for the sake of less than a hundred quid a year.

3. It Reassures Clients

Look:

We’ve all heard horror stories in the media about dodgy, unqualified therapists wreaking havoc on the mental well-being of their clients.

If we’ve heard them, chances are our clients have heard them too, which means they’re savvy about finding a reputable, legitimate counsellor.

Investing in insurance is an excellent way to prove that you’re the real deal, boosting your reputation as a counsellor clients can trust.

4. It Could Save Your Business

Last but certainly not least, let’s remember that, as counsellors, the safety and well-being of our clients are our number one priority.

Everything we do is designed to ensure we’re delivering the best possible service for those who step through our door, but even then, there’s always the risk that something could go awry and a client files a claim for compensation against you.

When you’re insured, you have a level of protection against such claims.

When you’re not insured, you’re pretty much screwed. Should that claim be successful, you’ll end up paying it out of your own pocket, causing the kind of financial and reputational damage that makes it difficult -if not impossible- to keep working as a counsellor in private practice.

Top 3 Insurance Companies for Counsellors in the UK

So, we all agree that investing in counsellor insurance is a smart idea to protect both you and your clients, but where exactly do you get this insurance?

Below, we’ll look at your top three options.

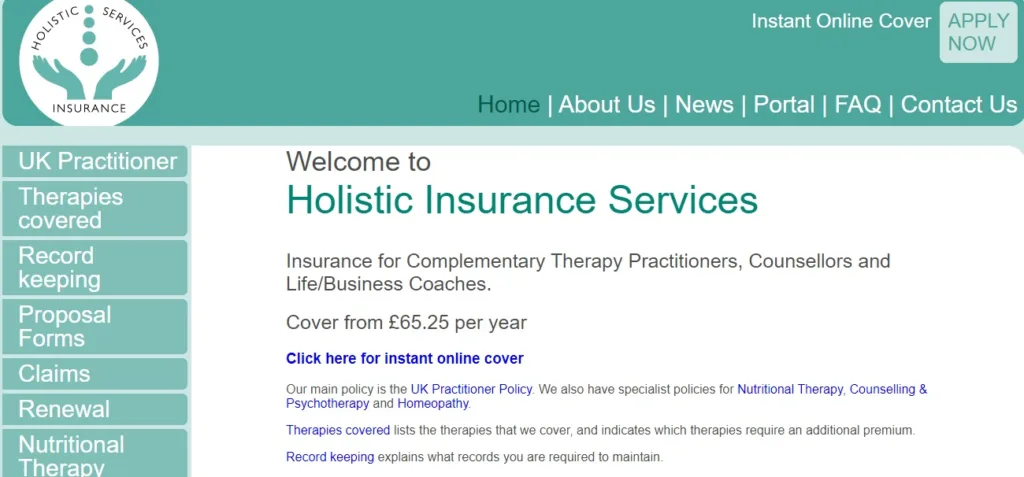

1. Holistic Insurance Services

Holistic Insurance Services are the company I’m currently insured with.

I’ve been with them since my days as a trainee, and, to be honest, I first signed up with them only because I got a discount via my hypnotherapy training provider.

Later, when it came time to start racking up my 100 hours in placement, I discovered I could also get coverage as a student counsellor for no extra cost.

The more I dealt with Holistic, the more I found them helpful and incredibly easy to deal with.

There have been a few times when I’ve needed to reach out to Holistic in the past, and, despite giving the impression that they’re a pretty small outfit, I always received a fast response with any questions or problems I had taken care of in no time.

Combine that with the fact they’re as affordable as any company out there, and I have no problem recommending them as a great insurance provider for UK counsellors.

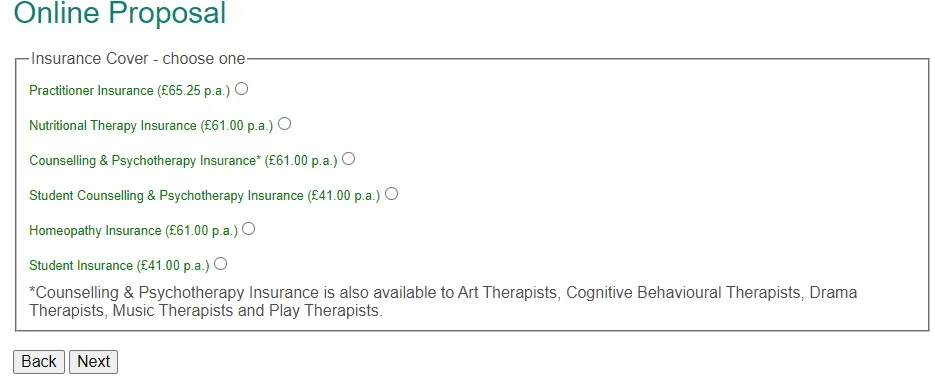

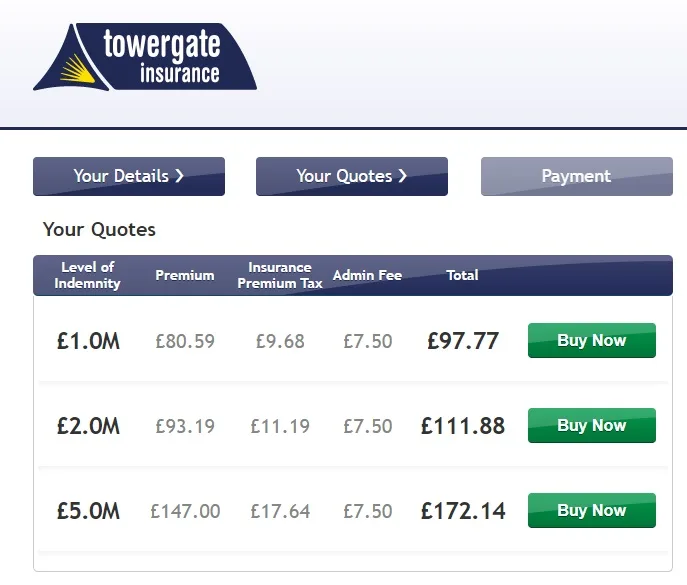

2. Towergate Insurance

I’ve never actually used Towergate Insurance, so I can’t give you my personal opinion.

What I can tell you is that I often see the company recommended by users of the Counselling Tutor Facebook group. If you’re one of the 47,000+ members of that group, you’ll know they’re a very knowledgeable bunch of trainees and qualified counsellors, and if they say Towergate is a good option, I certainly wouldn’t argue with them.

What I would say is that they seem to be a more expensive option.

I used the exact same details to get quotes from all three insurers. Towergate Insurance would cost me over £30 more than Holistic Insurance but provides a level of indemnity up to £1 million, while Holistic’s coverage only goes up to £500,000.

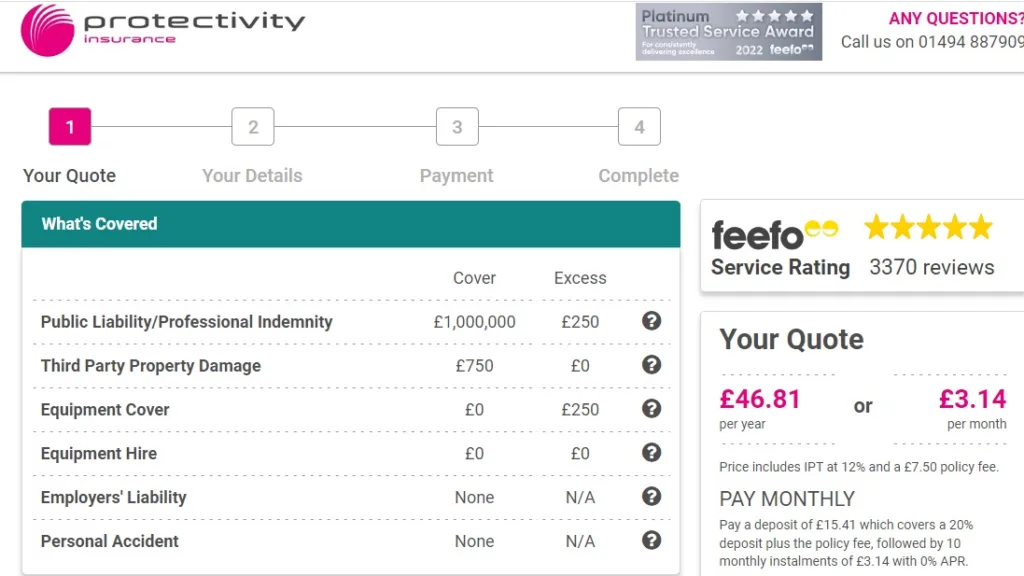

3. Protectivity Insurance

Protectivity may be the best insurance for UK counsellors on a budget, providing £1 million of coverage for less than £50.

The company also offers the option to put down a small deposit and pay monthly, making it easier to spread the costs.

If I were starting over and didn’t have much money to spend on launching a therapy practice, I’d undoubtedly seriously consider Protectivity.

Their website is straightforward, meaning generating an accurate quote and paying for your insurance only takes seconds.

The only potential downside is that they don’t cover student counsellors, whereas Holistic and Towergate do. If you’re reading this because you’re about to start your placement, this will rule Protectivity out as an option.

Frequently Asked Questions

How much is counselling insurance in the UK?

Getting insured as a counsellor typically costs between £46 – £100 per year, depending on your insurance provider and the level of coverage you take out.

Do I need extra insurance for walk-and-talk therapy?

Apparently not. I did my Level 4 research project on walk-and-talk therapy and discovered, to my surprise, that your standard public liability insurance covers this approach.

Do you need insurance as a student counsellor?

This varies. Some placement providers will cover you under their insurance, whereas others will require you to take out your own insurance before you start working towards your 100 hours.

Insurance for Counsellors in the UK: Summed Up

Ultimately, what all this boils down to is that if you’re serious about starting a legitimate private practice where client safety is your top priority, you’re going to need insurance.

Public liability and professional indemnity insurance are typically bundled into one package by most companies offering therapy-specific insurance, though the level of coverage provided may vary.

Still in the early stages of starting your business? You might also find my guide on writing a business plan helpful.

Enjoyed this post? Get more marketing advice for therapists every week by following Therapist Marketing Tips on Facebook.

Comments are closed.